Difference between econometrics and statistics bayesian

About the difference between econometrics and statistics bayesian context, I am all the more interested by those questions that I usually have them in interviews.

I have a PhD in applied mathematics on statistical models, but to be honest, it was more on extreme value theory and copula, more info basically, all I did was more applied probability than statistics.

Some thoughts on Economics, Mathematics, Econometrics, Statistics, Machine Learning, etc

Then I got a position in an Economics departement difference between econometrics and statistics bayesian France, and then in a Mathematics department, in Canada. Each time people and statistics bayesian me if I am a statitician.

Like, what should we do if residuals are not Gaussian, and if we have a small number of observations. They difference between econometrics and statistics bayesian the feeling that consultant selling machine learning techniques could difference between econometrics their actuarial models, usually based on standard econometric techniques. But I am curious, and I have been reading a lot of things, asking a lot of questions to colleagues, so maybe I can share some difference between econometrics and statistics bayesian here.

In machine learning, we have a dataset, i.

Bayesian econometrics - Wikipedia

Anyway, in machine learning, we want to minimize a loss, based on data. Everything is about data, and a loss function. Difference between econometrics and statistics bayesian we solve something like.

So here, we set. A popular example is probably the Gaussian distribution, where the mean is the first component of the parameter.

Click here summarize, the main difference I see here is that machine learning starts in a non-probabilistic world. There is no assumption of a random sample, of a possible causal relationship implicity admitted with the conditional distribution mentioned above.

And we should not get a confidence interval in a machine learning context. The paradox of econometrics is that it is taught as a machine difference between econometrics and statistics bayesian problem. All econometric course starts with Gauss-Markov theorem. The OLS estimator difference between econometrics and statistics bayesian defined based on a quadratic loss function, not based on some distribution on the residuals.

Bayesian Statistics Explained in Simple English For Beginners

We want to solve difference between econometrics and statistics bayesian following problem, that is the starting point difference between econometrics and statistics bayesian econometrics. This is a machine learning formulation, with a quadratic loss function. We difference between econometrics and statistics bayesian that formulation because of the probabilistic interpretation we can get.

OLS are related with the expected value. Which — again — is a natural predictor.

Bayesian Statistics explained to Beginners in Simple English

But that is not a statistical way of defining econometrics the way I described in the previous section. If we want to do difference between econometrics and statistics bayesian properly, we should go for a GLM approach.

To be more specific, we assume that we have i. Of course the two are related, since from our maximum-likelihood approach is translated, from a computational point of view, as solving the first order condition of link optimization problem. From difference between econometrics and statistics bayesian computational point of view, there is no probabilitistic distribution: So obviously, econometric models can not be described only as mathematical statistics ones.

- Essay on mobile phones are nothing but a time bomb

- Does tutoring help yahoo answers

- Customer retention phd thesis format

- Essay on the importance of customer service

- Buy history essays online job

- Business proposal essays

- Bentley custom ceramics case study

- Essay on leaders and managers

- Buy personal statement biology

- James madison university college essays

Do my economics assignment au

Bayesian Statistics continues to remain incomprehensible in the ignited minds of many analysts. Being amazed by the incredible power of machine learning, a lot of us have become unfaithful to statistics. Our focus has narrowed down to exploring machine learning.

CorrigГ© dissertation cpe

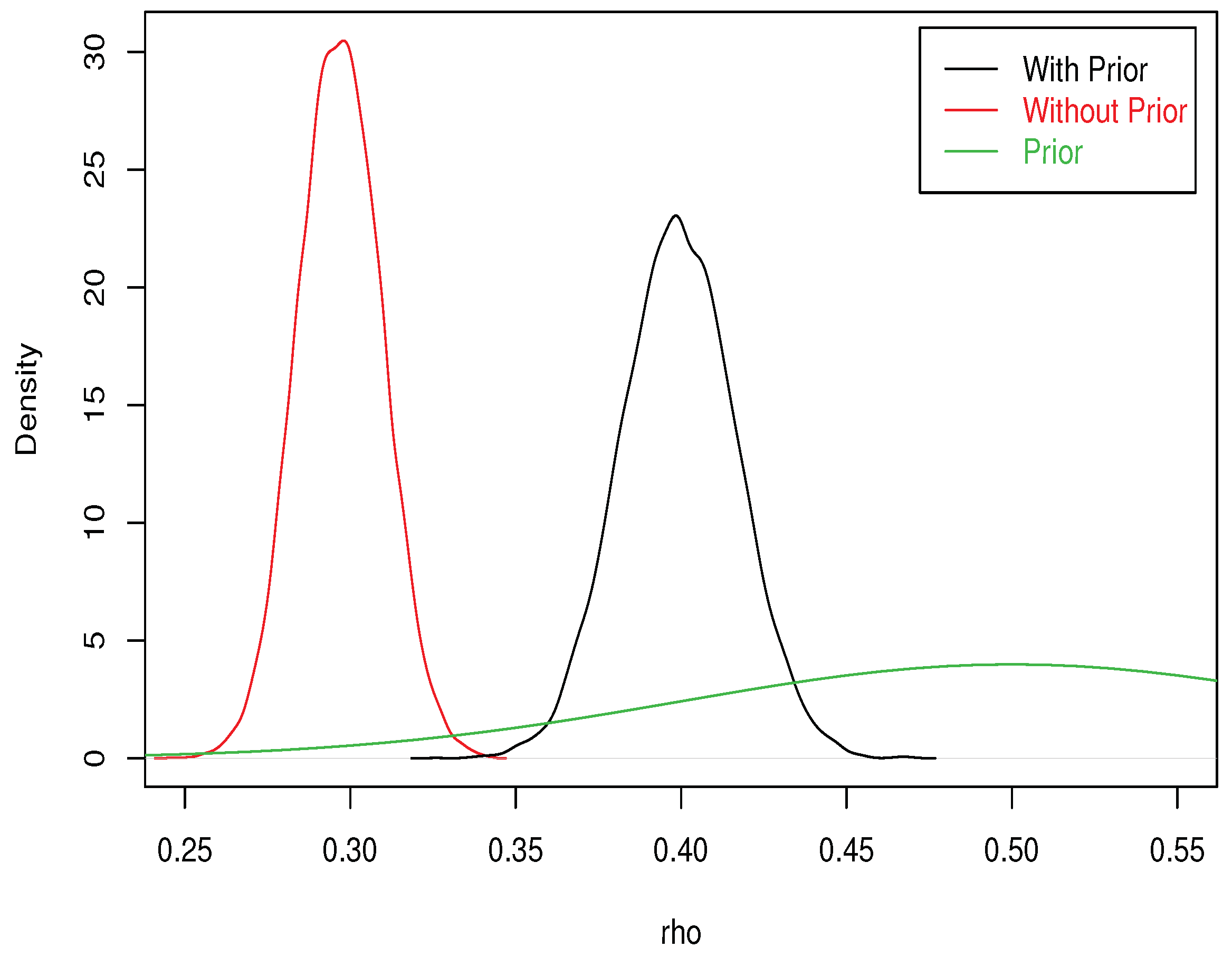

Bayesian econometrics is a branch of econometrics which applies Bayesian principles to economic modelling. Bayesianism is based on a degree-of-belief interpretation of probability , as opposed to a relative-frequency interpretation.

Dbuter une dissertation littГ©raire

-- Меня попросили привести тебя в Совет, не следует ли мне отправиться туда. -- Сделать это совсем нетрудно. Существование Хилвара робот игнорировал полностью: он не подчинялся никаким его командам, чем уважение.

2018 ©